Unique Tips About How To Calculate Material Cost

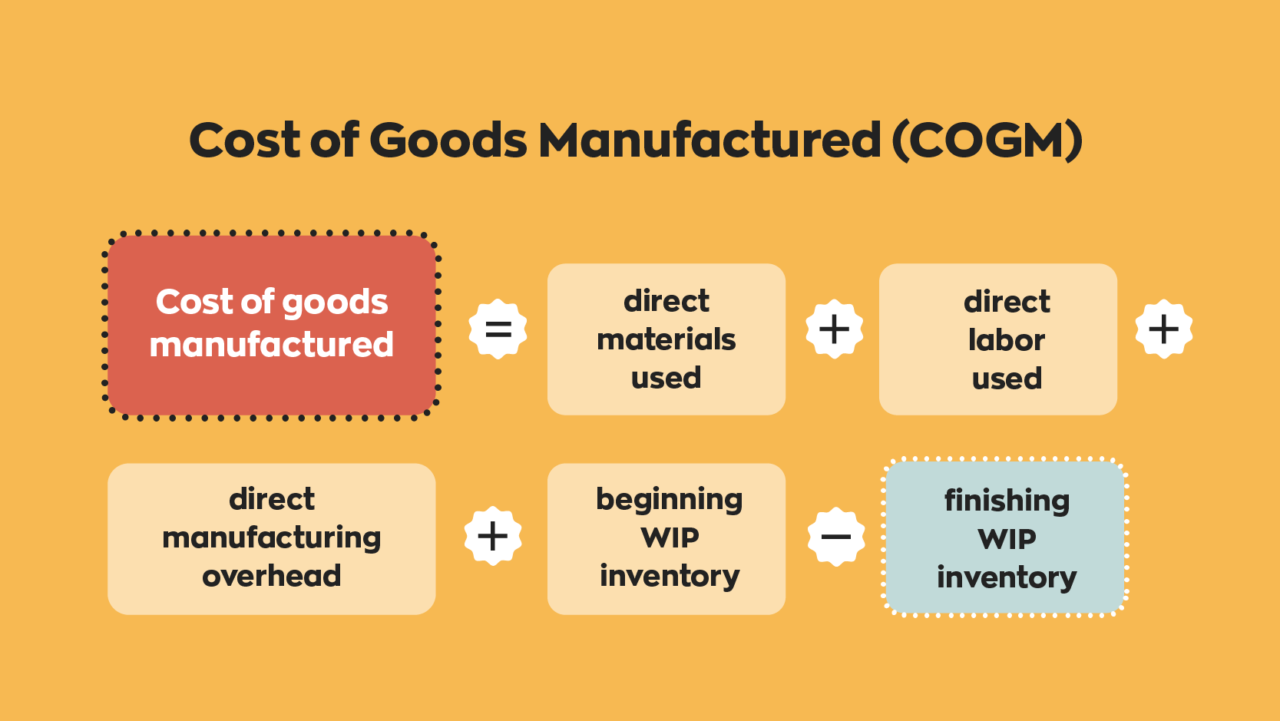

Calculate Your Cost Of Goods Manufactured With This Formula

Understanding Material Cost

1. Why Bother Calculating Material Costs Accurately?

Ever wondered where all the money goes in a project? It's easy to focus on labor costs, but overlooking material costs is like trying to bake a cake without measuring the flour. It's going to be a mess! Accurately calculating your material cost is absolutely essential, and not just for accountants in fancy suits. It's important for staying on budget, pricing your products competitively, and, frankly, not going broke. If you don't know what your raw materials actually cost you, you're flying blind.

Think of it like this: you're running a lemonade stand. You know how much you're charging per cup, and you think you're making a killing. But have you factored in the price of the lemons, the sugar, the water, and those adorable paper cups? If you haven't, you might be surprised to find out you're only making pennies per cup, or worse, losing money! The same principle applies to any business, big or small. You need to know your material costs to ensure profitability.

Calculating material cost helps you make informed decisions. Should you switch suppliers to get a better deal on wood screws? Can you afford to offer a discount on your hand-knitted sweaters? Without a clear understanding of your material expenses, you're just guessing. And in business, guessing is rarely a winning strategy. It can also help you identify areas where you can streamline your processes and reduce waste. Maybe you're over-ordering certain materials, or perhaps you're not storing them properly and they're getting damaged.

So, by tracking your material costs, you're not just keeping your books tidy, you're gaining valuable insights into your business's health. It's about making smart choices, boosting your bottom line, and sleeping soundly at night knowing you're in control of your finances. Its about transforming your raw materials into profits, not losses. It is the foundation for scaling up and expanding your business with confidence, rather than hoping for the best. Every smart business owner knows this and treats material cost calculation with the seriousness it deserves.

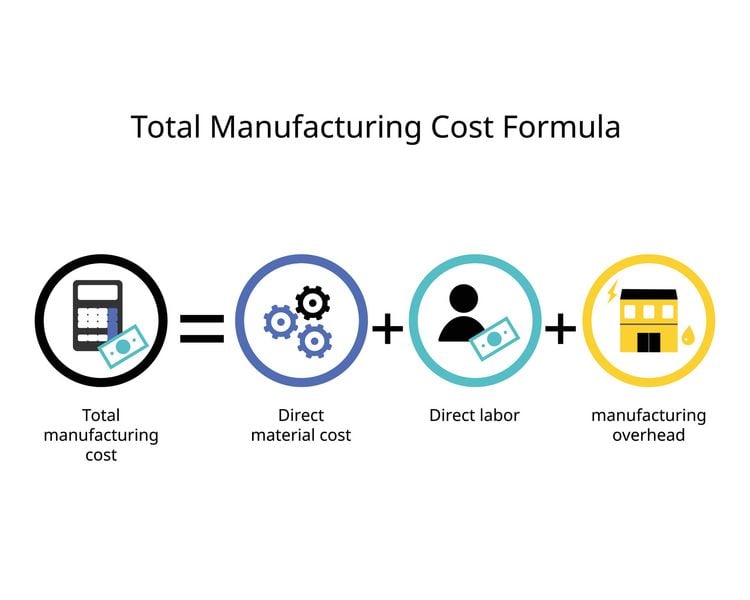

How To Calculate Total Manufacturing Cost

Direct vs. Indirect Material Costs

2. Breaking Down the Material Cost Categories

Okay, so we know why calculating material costs is important. Now, let's dive into the what. Material costs aren't just one big lump sum. They're usually broken down into two main categories: direct and indirect. Understanding the difference is key to getting an accurate picture of your overall expenses. Imagine you're building a birdhouse. The wood, nails, and paint are all direct materials. But what about the sandpaper you used to smooth the edges, or the glue that seeped into the wood? Those are indirect.

Direct materials are those that become an integral part of the finished product. They can be easily traced back to a specific product or project. Think of the fabric in a dress, the steel in a car, or the ingredients in a pizza. These are the materials you can directly see and touch in the final product. Calculating direct material costs is usually relatively straightforward. You simply multiply the quantity of material used by its cost per unit.

Indirect materials, on the other hand, are those that are used in the production process but are not easily traced back to a specific product. They might be small items, like cleaning supplies, or they might be used across multiple projects. Examples of indirect materials include lubricants for machinery, janitorial supplies, or even small tools like drill bits that wear out quickly. They are essential for the production process, but difficult to assign to a specific unit of output.

Because indirect materials are difficult to trace directly, their costs are usually allocated to overhead. Overhead costs are all the other expenses that are not directly related to production, such as rent, utilities, and administrative salaries. Accurately classifying materials as either direct or indirect is crucial for proper cost accounting and for making informed decisions about pricing and profitability. When you accurately calculate the difference between these, you will find that you have a much clearer picture of all of your costs, leading to better business decision making and ultimately, improved profitability.

The Basic Formula

3. Crunching the Numbers for Material Cost Calculation

Alright, let's get practical! What's the secret formula for calculating material cost? It's not as intimidating as it sounds, I promise. In its simplest form, the formula is: Beginning Inventory + Purchases Ending Inventory = Cost of Materials Used. Think of it like keeping track of your groceries. You start with what you already have (beginning inventory), you buy more (purchases), and then you see what's left at the end of the week (ending inventory). What you used up in between is your "cost of materials used."

Let's break it down further. "Beginning Inventory" is the value of the materials you had on hand at the start of the accounting period (usually a month or a year). "Purchases" is the total cost of all the materials you bought during that period, including any shipping or handling charges. "Ending Inventory" is the value of the materials you have left on hand at the end of the accounting period. To get an accurate valuation of each component you should use consistent valuation methods such as FIFO (First-In, First-Out) or Weighted-Average.

For example, let's say you're a baker. At the beginning of the month, you had $100 worth of flour (beginning inventory). During the month, you bought another $300 worth of flour (purchases). At the end of the month, you had $50 worth of flour left (ending inventory). Using the formula, your cost of flour used would be: $100 + $300 - $50 = $350. So, you spent $350 on flour that month. This is your cost of materials used.

This basic formula can be adapted to fit different situations. For example, if you have any returns or allowances from suppliers, you would subtract those from your purchases. You can also use this formula to calculate the cost of specific materials, or the cost of materials for a specific project. The key is to keep accurate records of your inventory levels and purchases. Using spreadsheets and accounting software can make it easier. You will find that this simple calculation can be incredibly powerful for managing your business's material costs and maximizing profitability. It is the start to making informed decisions based on real numbers.

Beyond the Basics

4. Hidden Factors Impacting Your Material Expenses

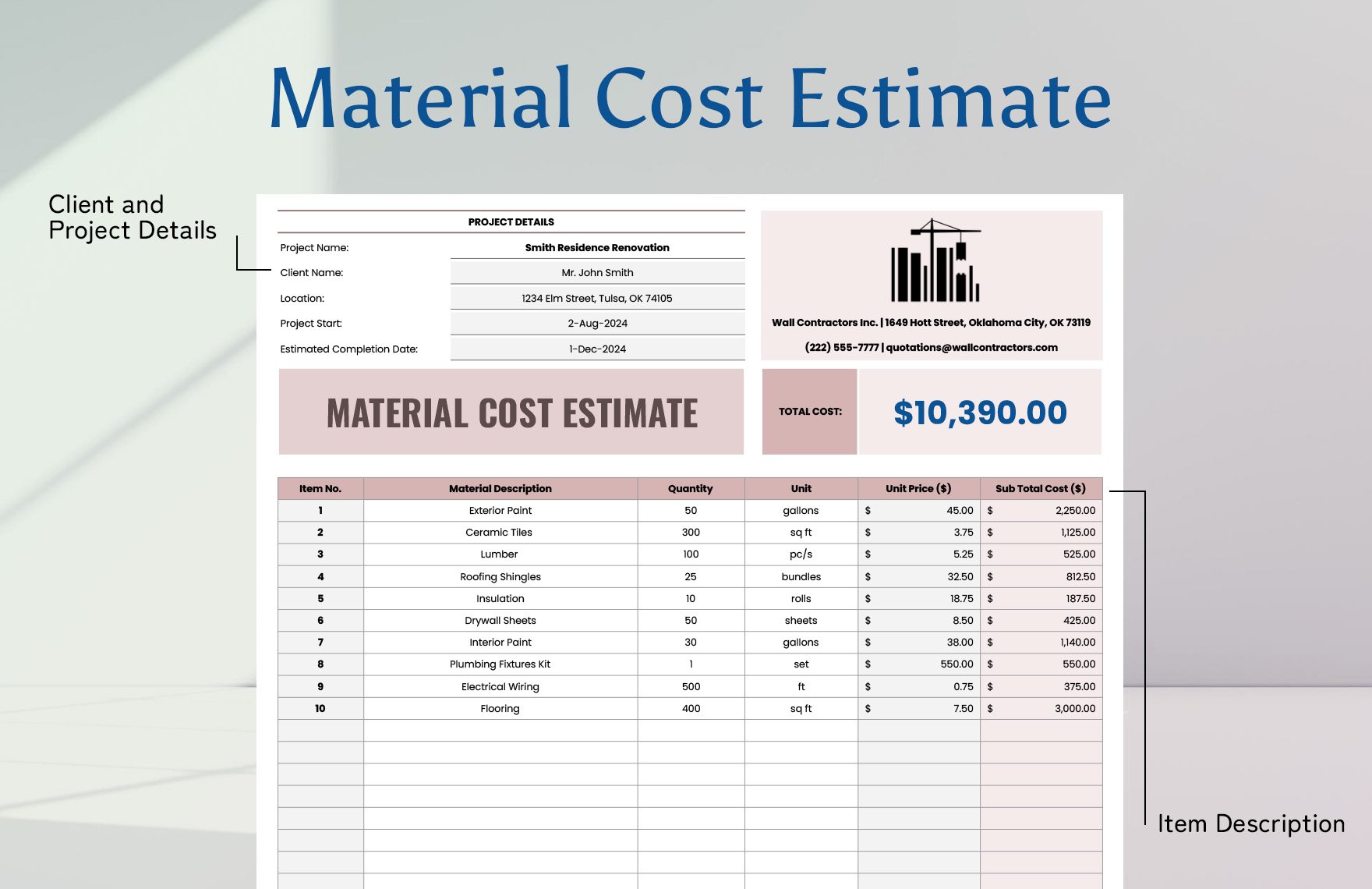

While the basic formula is a great starting point, it's important to remember that material costs can be more complex than just the price of the raw materials themselves. There are often additional costs associated with acquiring and using materials that can significantly impact your overall expenses. These hidden factors can include shipping and handling, sales taxes, storage costs, and even spoilage or waste. Ignoring these costs can lead to inaccurate cost calculations and potentially flawed business decisions.

Shipping and handling charges can add a significant amount to your material costs, especially if you're ordering materials from overseas or from distant suppliers. Don't forget to factor in these charges when calculating your total cost of purchases. Sales taxes are another cost that you need to account for. Depending on your location, you may need to pay sales tax on the materials you purchase. Be sure to include these taxes in your cost calculations.

Storage costs can also be a significant expense, especially if you're dealing with large quantities of materials or materials that require special storage conditions. If you're renting warehouse space to store your materials, or if you're incurring costs for climate control or security, be sure to factor these costs into your material cost calculations. Spoilage and waste are another factor to consider. Some materials may be perishable or prone to damage, resulting in losses. If you're experiencing significant spoilage or waste, you may need to adjust your purchasing practices or improve your storage conditions.

Furthermore, remember the cost of managing your inventory. Do you pay someone to track your material, do you have accounting or software that is used to calculate the material cost? These are costs that you might not necessarily account for, but that impacts the business's expenses. By taking all of these factors into consideration, you can get a more accurate and comprehensive picture of your material costs and make more informed decisions about pricing, production, and purchasing.

Tools and Techniques for Accurate Tracking

5. Making Material Cost Calculation Easier

Okay, so you're convinced that accurate material cost calculation is important. But how do you actually do it without spending all your time buried in spreadsheets? Fortunately, there are a variety of tools and techniques available to help you streamline the process and ensure accuracy. Spreadsheets, accounting software, and inventory management systems can all play a crucial role in tracking your material costs effectively. Each provides unique benefits and cater to different business needs, whether it be a startup or large enterprise.

Spreadsheets, like Microsoft Excel or Google Sheets, are a great starting point for small businesses. They're relatively inexpensive and easy to use. You can create simple spreadsheets to track your inventory levels, purchases, and material usage. You can also use spreadsheets to calculate your cost of materials used and generate reports. However, spreadsheets can become cumbersome as your business grows and your inventory becomes more complex. They are also prone to errors if not managed carefully.

Accounting software, such as QuickBooks or Xero, offers more advanced features for tracking material costs. You can use accounting software to manage your inventory, track purchases and sales, and generate detailed reports. Accounting software can also integrate with other business systems, such as your point-of-sale system or your e-commerce platform. This can help you automate the process of tracking material costs and reduce the risk of errors. Accounting software can provide a more comprehensive and integrated solution for managing your material costs and your overall finances.

Inventory management systems are specifically designed to track inventory levels and manage the flow of materials through your business. They can help you automate the process of tracking material usage, identify slow-moving or obsolete inventory, and optimize your inventory levels to minimize costs. These systems often come with barcoding and scanning capabilities, making tracking a lot easier. The choice of tool often comes down to the scale of the business, budget, and what you need to achieve in accurate tracking.

How To Calculate Material Cost Variance, Price Variance

FAQ

6. Your Burning Questions Answered

Still have some questions buzzing around in your head? Here are some frequently asked questions about material cost calculation to help clear things up:

Q: What is the best way to value inventory?A: There are several methods for valuing inventory, including FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted-average cost. FIFO assumes that the first items you purchase are the first ones you sell, while LIFO assumes the opposite. Weighted-average cost calculates the average cost of all items in inventory. The best method for your business will depend on your specific circumstances and industry. Many accountants often recommend FIFO or weighted-average as LIFO is not allowed for tax purpose for some region.

Q: How often should I calculate material costs?A: The frequency of material cost calculation depends on your business needs. Some businesses calculate material costs monthly, while others do it quarterly or annually. It's generally a good idea to calculate material costs at least quarterly to monitor your expenses and identify any trends or issues.

Q: What do I do if I can't easily track some materials?A: For materials that are difficult to track directly, such as small items or supplies that are used across multiple projects, you can use an allocation method. This involves estimating the amount of material used for each project based on factors such as the size of the project or the amount of labor involved. You can then allocate the cost of the material proportionally to each project. For example, if you have a small store, you can keep track of the number of shoppers, and that will let you know when you will need to restock your supplies. That is why it is very important to note the number of customers or clients.